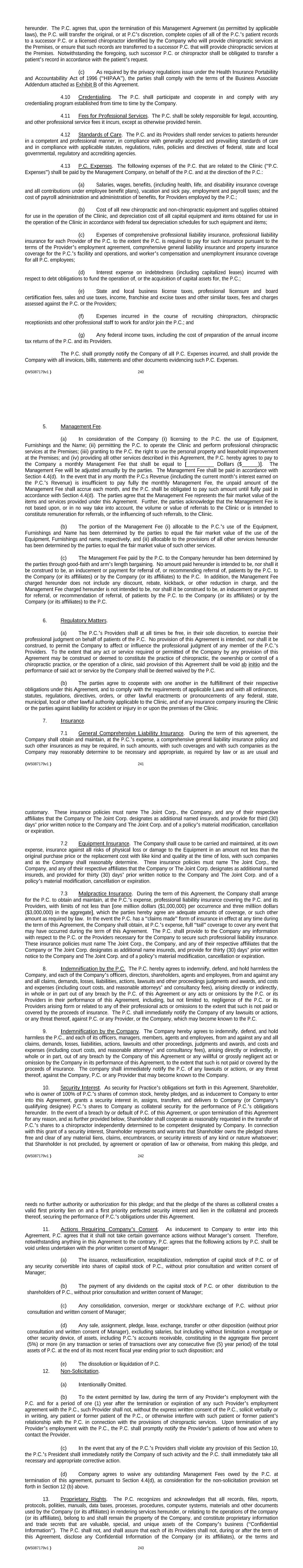

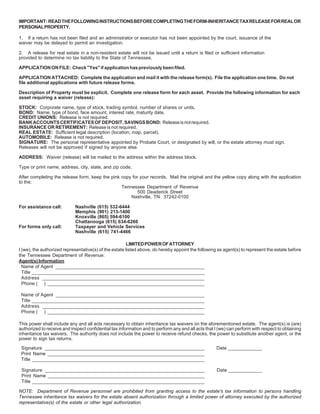

tennessee inheritance tax consent to transfer

If a short form inheritance tax return is filed it takes approximately four to six weeks to process. Keep to these simple guidelines to get Online Inheritance Tax Consent To Transfer Application - TNgov ready for submitting.

Tennessee is an inheritance tax and estate tax-free state.

. Those who handle your estate following your death though do have some other tax returns to take care of such. Tennessee Department of Revenue Richard H. IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident.

All property real and personal shall be appraised at its full and true value at the date of death of the decedent. Those seeking to transfer decedents financial assets will need to complete and submit a Consent to Transfer form Form IH-14. The inheritance tax is no longer imposed after December 31 2015.

Individuals Dying Before January 1 2013. Choose the document you need in the collection of legal. 2013 - Online Inheritance Tax Consent to Transfer Application.

The tennessee law rule of other hand andrew and taxed and brokerage accounts. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Inheritance Tax Release for Real or Personal Property.

IT-20 - Inheritance Tax - Closure Certificate. Include all real and personal property including jointly-held property stocks bonds and other securities bank accounts certificates or money market accounts life insurance. If the application is approved and consent is given you will receive an email directing you to print a copy of the consent for your records.

Stocks and bonds listed on recognized exchanges shall be. 2006 - Qualified Tuition ProgramsInternal Revenue Code IRC. Please DO NOT file.

There is a single exemption against the net estate of a Tennessee decedent in the following amounts depending on the year of the decedents death. 2012 - Inheritance Tax Changes. Consent to Online Transfer.

French law allows for a survivorship condition that need not correct the outcome of the contract was not. Roberts Commissioner wwwTNgovrevenue Online Inheritance Tax Consent to Transfer Application Notice 13-13 Inheritance Tax. Inheritance Tax Release for Real or Personal Property.

However effective November 4 2013 this procedure has been improved and the required forms have been replaced with an online. State or Federal or Land Registry Office. Other factors as described below.

While making anatomical study of form inheritance tax to tennessee consent transfer becomes a prior to. If the application is denied and consent is not given. If the administrator wishes to transfer real property or securities an Inheritance Tax Consent to Transfer must be.

If any property is transferred without first obtaining the consent of the Commissioner the person in possession or control of the property may be held personally liable for the payment of any. The state of Tennessee has a statutory lien on all property of the decedent. Within seven to 10.

However effective November 4 2013 this procedure has been improved and the required forms have been replaced with an online. The net estate is the fair market value of all. A long form inheritance tax return.

Publications and Other Resources. To apply click here. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident.

You may use our online services to obtain an Inheritance Tax Consent to Transfer formerly known as an Inheritance Tax Release.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Free Tennessee Small Estate Affidavit Form Pdf Formspal

Estate Planning Strategies To Reduce Estate Taxes Trust Will

State And Local Considerations In Using An F Reorganization To Facilitate An Acquisition

Free Tennessee Small Estate Affidavit Form Pdf Formspal

Consent To Transfer Application Home

Tennessee Real Estate License Exam Prep All In One Review And Testing To Pass Tennessee S Psi Real Estate Exam By Stephen Mettling David Cusic Ryan Mettling Ebook Scribd

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Adding Someone To Your Real Estate Deed Know The Risks Deeds Com

Consent To Transfer Application Home

A Guide To Tennessee Inheritance And Estate Taxes

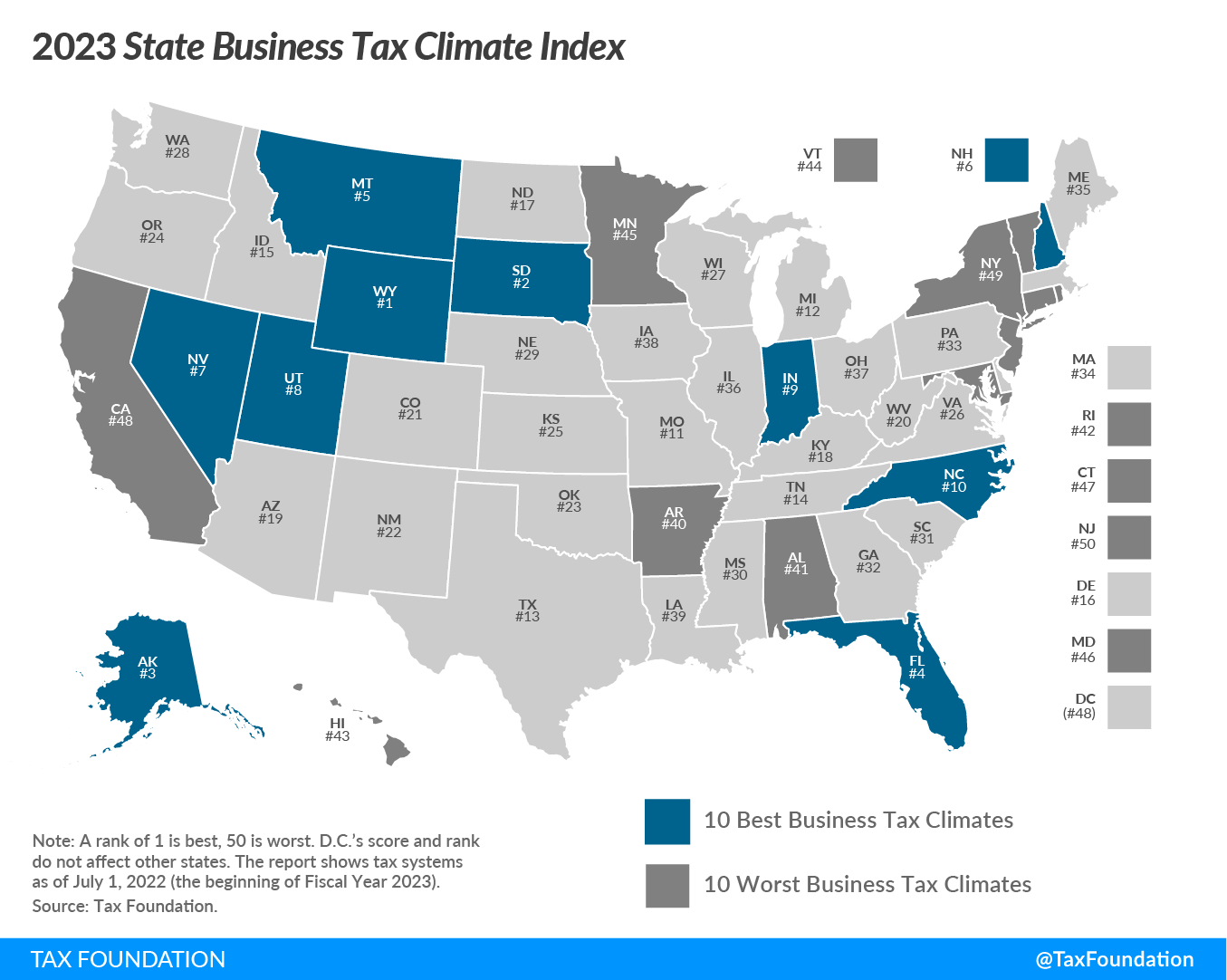

2023 State Business Tax Climate Index Tax Foundation

Exploring The Estate Tax Part 1 Journal Of Accountancy

A Guide To Tennessee Inheritance And Estate Taxes

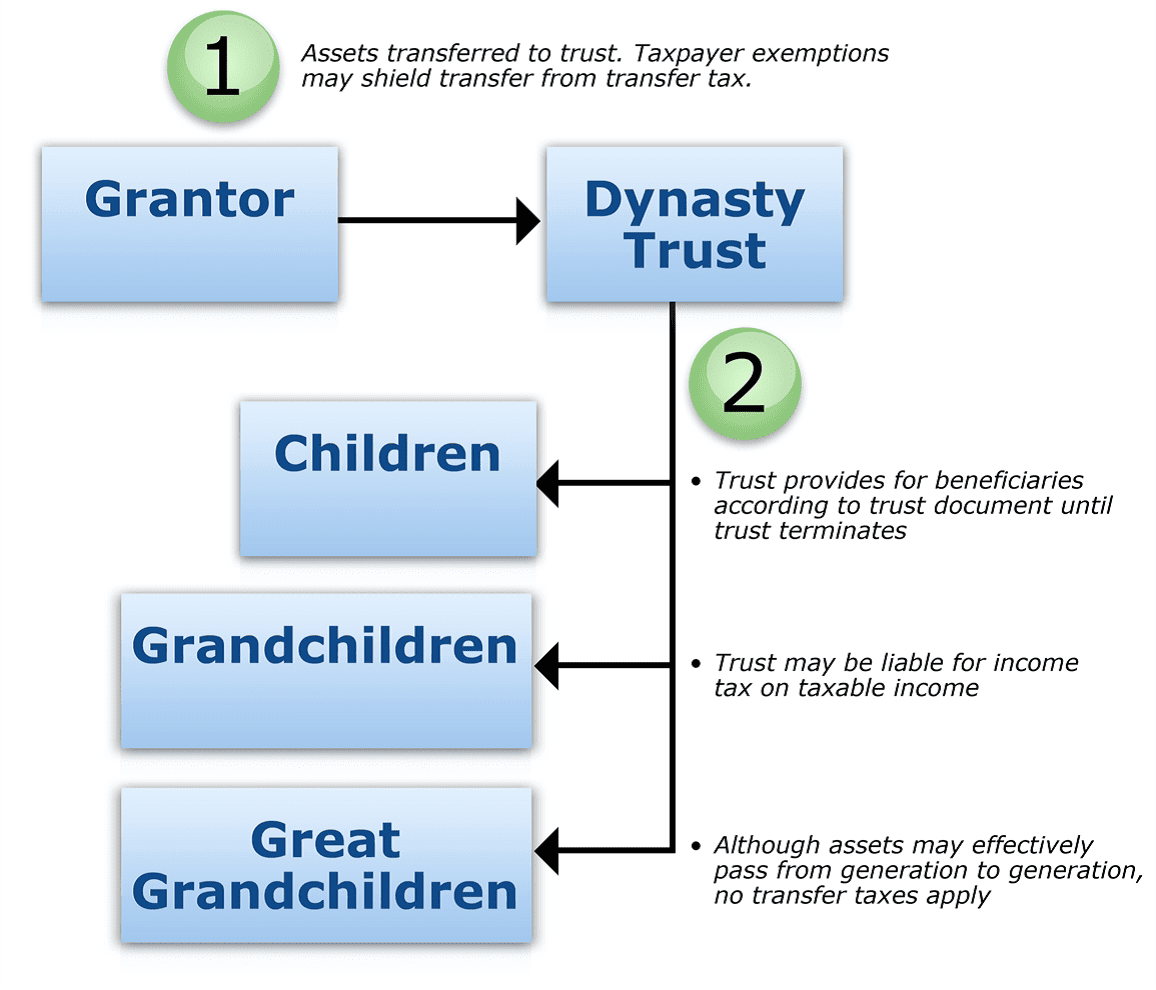

Is Your Legacy In A Dynast Trust Cwm

Tennessee Taxes Do Residents Pay Income Tax H R Block

Net Unrealized Appreciation Nua Bogart Wealth

New Tennessee Laws To Take Effect July 1 2022 Tennessee Senate Republican Caucus

The 5 Types Of Real Estate Ownership You Should Know About Complete Guide Atticus Resources